Some Known Details About Stonewell Bookkeeping

Table of ContentsAll About Stonewell BookkeepingSome Known Details About Stonewell Bookkeeping Some Of Stonewell BookkeepingThe smart Trick of Stonewell Bookkeeping That Nobody is Talking AboutThings about Stonewell Bookkeeping

Every business, from hand-crafted cloth makers to game developers to restaurant chains, makes and invests money. You could not totally understand or also start to fully value what an accountant does.The background of accounting dates back to the start of commerce, around 2600 B.C. Early Babylonian and Mesopotamian accountants kept records on clay tablets to keep accounts of transactions in remote cities. In colonial America, a Waste Book was traditionally utilized in accounting. It included a daily diary of every transaction in the chronological order.

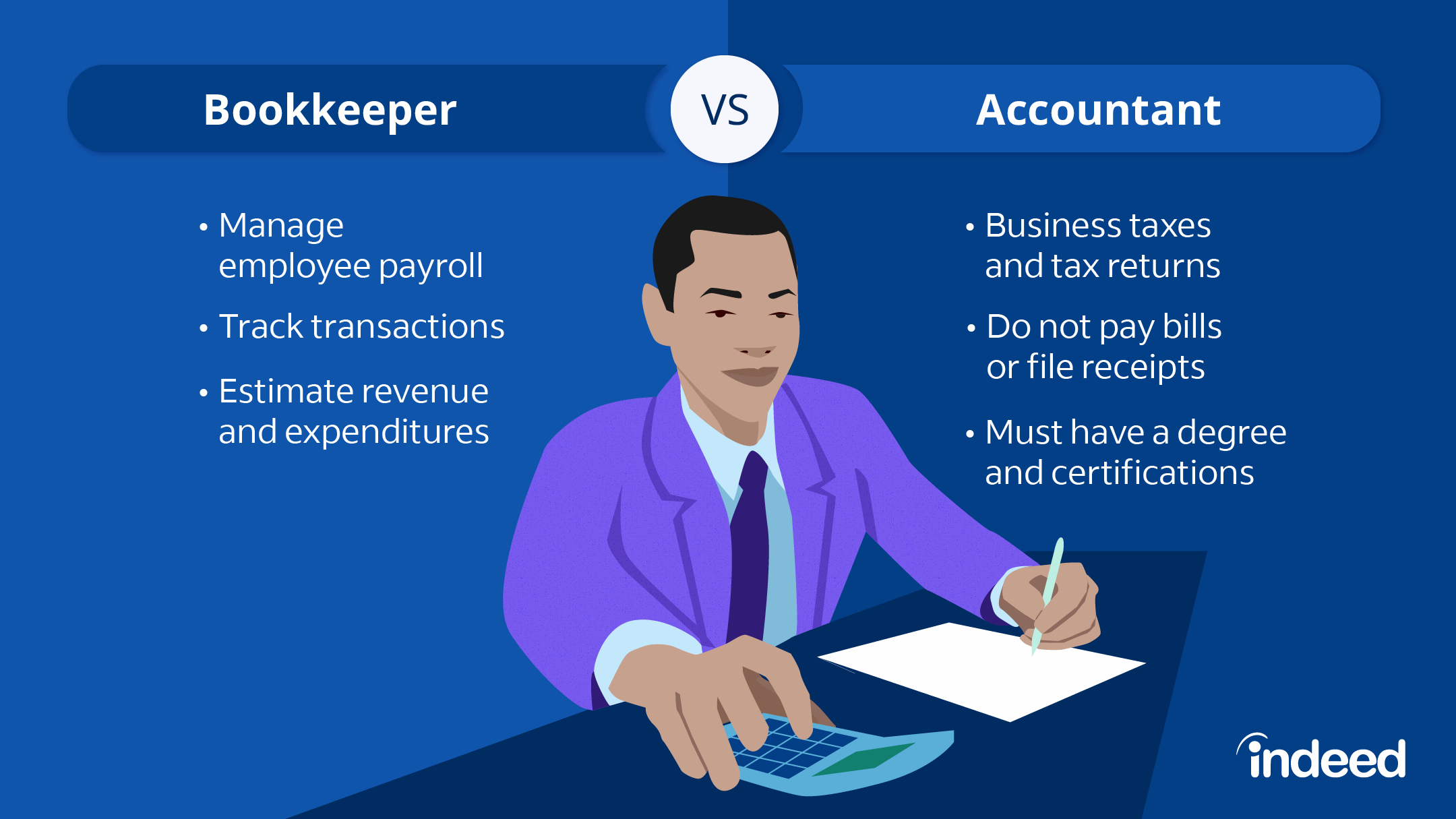

Small companies may count only on a bookkeeper initially, yet as they grow, having both experts aboard becomes increasingly valuable. There are two major types of bookkeeping: single-entry and double-entry bookkeeping. documents one side of a financial deal, such as including $100 to your cost account when you make a $100 acquisition with your bank card.

Facts About Stonewell Bookkeeping Uncovered

entails recording financial purchases by hand or utilizing spreadsheets - White Label Bookkeeping. While low-cost, it's time consuming and vulnerable to errors. usages devices like Sage Expense Administration. These systems automatically sync with your charge card networks to give you credit card transaction data in real-time, and immediately code all information around expenditures including tasks, GL codes, places, and groups.

In addition, some accountants likewise aid in optimizing pay-roll and billing generation for an organization. An effective accountant requires the complying with abilities: Accuracy is key in monetary recordkeeping.

They usually begin with a macro point of view, such as a balance sheet or a revenue and loss statement, and afterwards drill into the information. Bookkeepers make certain that vendor and client documents are constantly as much as date, even as individuals and businesses adjustment. They might additionally require to coordinate with other departments to make sure that everyone is utilizing the exact same data.

Some Known Incorrect Statements About Stonewell Bookkeeping

Going into bills into the accountancy system allows for accurate planning and decision-making. This aids businesses get payments quicker and improve cash money flow.

Involve inner auditors and contrast their counts with the taped worths. Bookkeepers can work as consultants or internal staff members, and their settlement varies depending on the nature of their work.

That being claimed,. This variant is influenced by aspects like place, experience, and skill level. Freelancers commonly bill by the hour yet may supply flat-rate bundles for details jobs. According to the United States Bureau of Labor Data, the average bookkeeper salary in the United States is. Keep in mind that wages can vary relying on experience, education and learning, place, and market.

The smart Trick of Stonewell Bookkeeping That Nobody is Talking About

Some of the most usual paperwork that organizations must send to the federal government includesTransaction information Financial statementsTax conformity reportsCash flow reportsIf your accounting depends on date all year, you can prevent a lots of stress throughout tax period. best franchises to own. Perseverance and interest to detail are key to far better accounting

Seasonality belongs of any type of job worldwide. For accountants, seasonality means durations when settlements come flying in via the roofing, where having impressive work can come to be a major blocker. It ends up being crucial to prepare for these minutes beforehand and to finish any kind of stockpile before the pressure period hits.

A Biased View of Stonewell Bookkeeping

Avoiding this will minimize the danger of activating an IRS audit as it supplies a precise representation of your financial resources. Some usual to keep your personal and service financial resources different areUsing an organization bank card for all your business expensesHaving different checking accountsKeeping invoices for personal and service expenditures different Envision a world where your accounting is done for you.

These assimilations are self-serve and require no view it now coding. It can immediately import data such as employees, jobs, groups, GL codes, departments, job codes, price codes, tax obligations, and extra, while exporting costs as bills, journal entrances, or credit card charges in real-time.

Consider the adhering to ideas: A bookkeeper that has actually functioned with businesses in your market will certainly better recognize your details requirements. Ask for references or examine on-line evaluations to ensure you're working with a person dependable.